재무회계 Ch4 과제

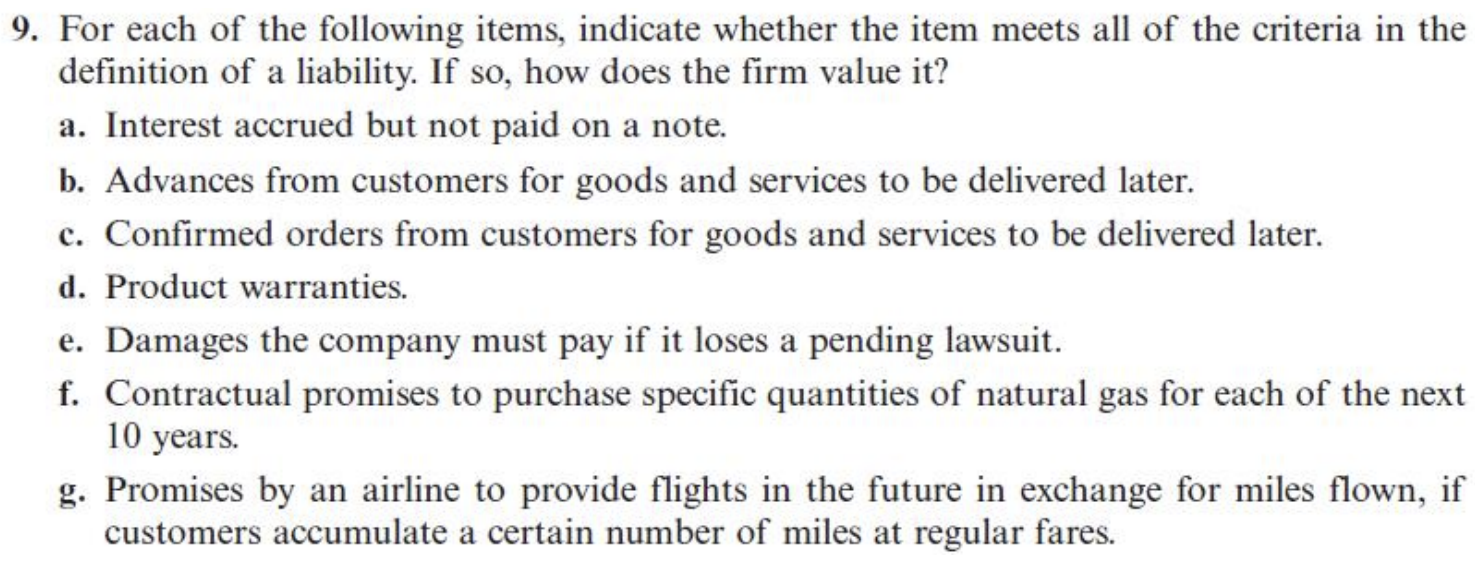

(1) Quetion 4-9

First, the criteria in the definition of a liablilty is following :

- Probably, future sacrifices of economic benefits.

- Arising from present obligation to transfer assets of privide services.

- As a result of a past transaction.

In this perspective,

(a) is a liability. accrued interest payable.

(b) is a liability.(Advances from customers) It is equal to amount of received cash.

(c) is not a liability. criteria (3) is not satisfied.

(d) is a liability.(Provisions) It can be valued by some ratio of original product’s price.

(e) can be liability or not. It depends on a probability of lawsuit.

If a probability of loss lawsuit is more than certain level,(In GAAP 80%, IFRS 50%) then it will be a liability. In that case, it can be valued by expected loss that should pay.

(f) is not a liability. criteria (3) is not satisfied.

(g) is a liability. It can be valued by some ratio of flight ticket’s regular price.

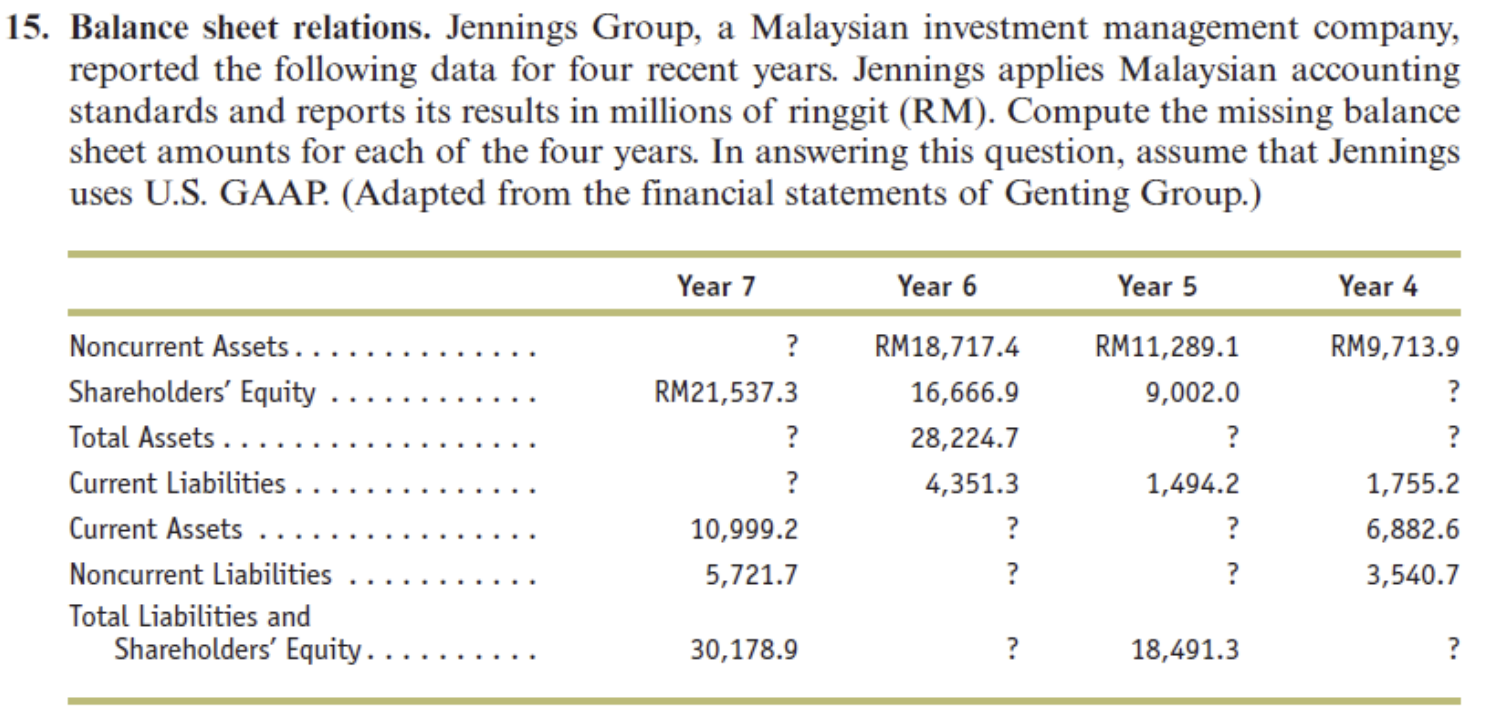

(2) Quetion 4-15

Total Assets = Current Assets + Noncurrent Assets

Total Liabilities = Current Liabilities + Noncurrent Liabilities

Total Liabilities and Shareholders’ Equity = Total Liabilities + Shareholders’ Equity

And, Total Assets = Total Liabilities and Shareholders’ Equity

Apply above,

| Category | Year7 | Year6 | Year5 | Year4 |

|---|---|---|---|---|

| Noncurrent Assets | 19,179.7 | 18,717.4 | 11,289.1 | 9,713.9 |

| Shareholders’ Equity | 21,537.3 | 16,666.9 | 9,002.0 | 11,300.6 |

| Total Assets | 30,178.9 | 28,224.7 | 18,491.3 | 16,596.5 |

| Current Liabilities | 2,919.9 | 4,351.3 | 1,494.2 | 1,755.2 |

| Current Assets | 10,999.2 | 9,507.3 | 7,202.2 | 6,882.6 |

| Noncurrent Liabilities | 5,721.7 | 7,206.5 | 7,995.1 | 3,540.7 |

| Total Liabilities and Equity | 30,178.9 | 28,224.7 | 18,491.3 | 16,596.5 |